4 Easy Facts About Amur Capital Management Corporation Described

4 Easy Facts About Amur Capital Management Corporation Described

Blog Article

What Does Amur Capital Management Corporation Do?

Table of ContentsFascination About Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For EveryoneHow Amur Capital Management Corporation can Save You Time, Stress, and Money.4 Easy Facts About Amur Capital Management Corporation DescribedThe Best Guide To Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals Explained

This makes genuine estate a profitable lasting financial investment. Real estate investing is not the only means to invest.:max_bytes(150000):strip_icc()/foreign-portfolio-investment-fpi.asp-final-cfb0ab9482a644cdb1164ddedea9dcb6.png)

More About Amur Capital Management Corporation

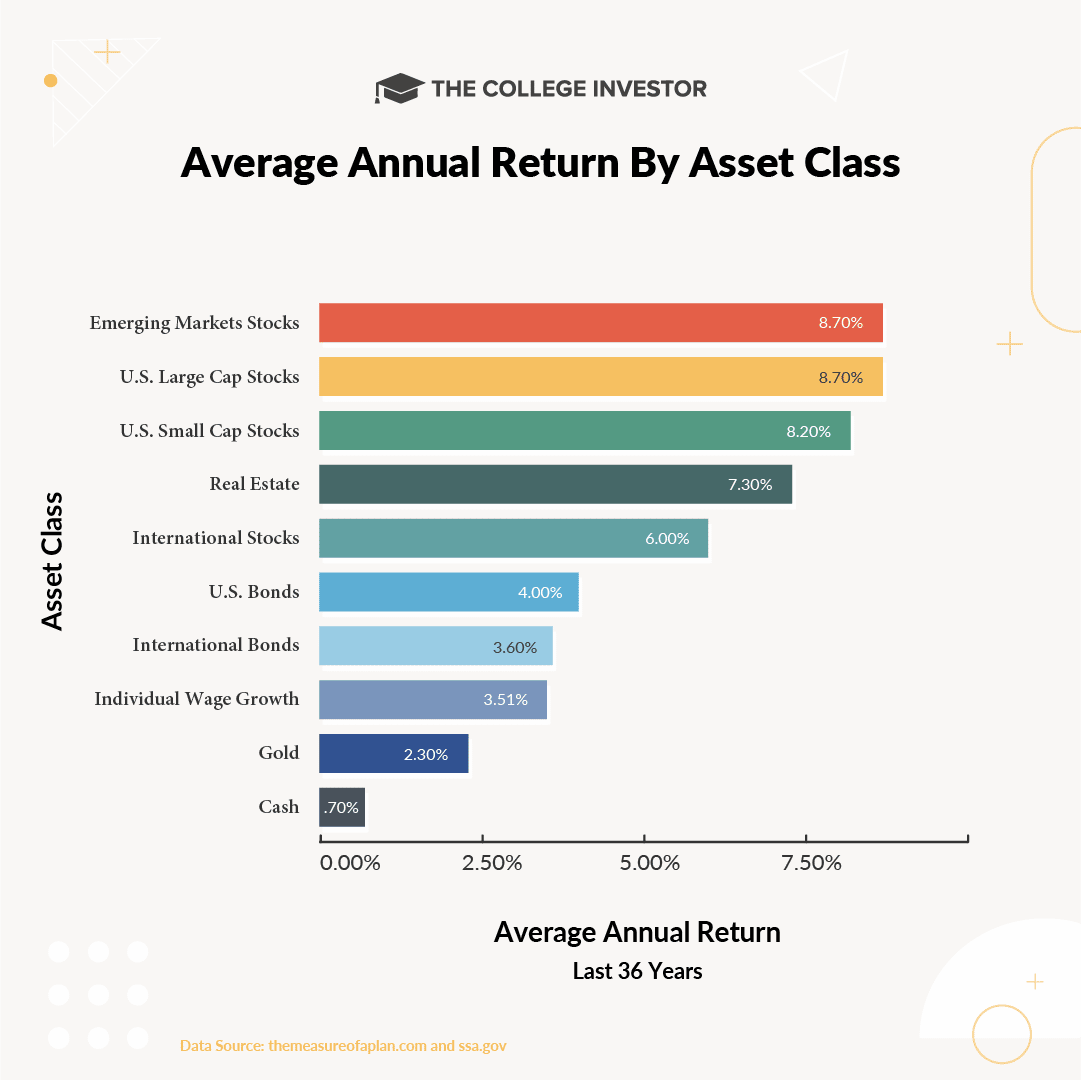

Considering that 1945, the typical big supply has actually returned close to 10 percent a year. That said, stocks might just as quickly diminish.

That said, real estate is the polar contrary relating to specific elements. Net revenues in actual estate are reflective of your very own actions.

Any cash got or lost is a straight outcome of what you do. Stocks and bonds, while commonly lumped together, are basically various from each other. Unlike stocks, bonds are not rep of a stake in a company. Consequently, the return on a bond is taken care of and does not have the opportunity to value.

The Only Guide for Amur Capital Management Corporation

The actual advantage real estate holds over bonds is the moment structure for holding the investments and the rate of return during that time. Bonds pay a fixed rate of rate of interest over the life of the financial investment, therefore acquiring power with that said passion goes down with rising cost of living with time (mortgage investment corporation). Rental residential property, on the other hand, can produce higher rents in periods of greater inflation

It is as simple as that. There will constantly be a need for the valuable metal, as "Fifty percent of the world's population relies on gold," according to Chris Hyzy, chief financial investment police officer at united state Count on, the private wealth monitoring arm of Financial institution of America in New York City. According to the World Gold Council, demand softened in 2014.

Amur Capital Management Corporation Fundamentals Explained

Consequently, gold costs should return down-to-earth. This ought to bring in innovators wanting to profit from the ground degree. Identified as a fairly secure commodity, gold has actually established itself as an automobile to enhance financial investment returns. Some don't even take into consideration gold to be an investment at all, rather a bush versus inflation.

Obviously, as secure as gold may be thought about, it still stops working to continue to be as attractive as property. Right here are a couple of factors capitalists prefer realty over gold: Unlike property, there is no funding and, consequently, no room to leverage for growth. Unlike realty, gold suggests no tax obligation benefits.

6 Simple Techniques For Amur Capital Management Corporation

When the CD develops, you can collect the initial financial investment, along with some interest. Actual estate, on the other hand, can appreciate.

It is one of the most convenient ways to expand any profile. A common fund's performance is constantly measured in terms of complete return, or the sum of the modification in a fund's internet asset worth (NAV), its rewards, and its capital gains circulations over a given amount of time. A lot like stocks, you have little control over the efficiency of your assets.

Putting cash into a shared fund is essentially handing one's investment choices over to a specialist money manager. While you can decide on your investments, you have little state over just how they perform. The three most typical means to buy realty are as complies with: Acquire And Hold Rehabilitation Wholesale With the worst part of the economic crisis behind us, markets have gone through historic admiration prices in the last three years.

Amur Capital Management Corporation Things To Know Before You Buy

Getting low doesn't mean what it used to, and investors have actually identified that the weblink landscape is transforming. The spreads that wholesalers and rehabbers have become accustomed to are beginning to summon memories of 2006 when worths were historically high (mortgage investment corporation). Certainly, there are still plenty of chances to be had in the world of turning genuine estate, however a brand-new departure technique has arised as king: rental buildings

Otherwise called buy and hold properties, these homes feed off today's admiration rates and capitalize on the truth that homes are much more pricey than they were just a couple of short years ago. The principle of a buy and hold exit approach is basic: Investors will certainly look to boost their bottom line by renting out the building out and gathering month-to-month capital or just holding the residential or commercial property till it can be cost a later day for a profit, certainly.

Report this page